The largest exchanges in the world are choosing the OP Stack

Summary

The tokenization of RWAs is expected to be the primary driver of onchain asset growth over the next 10 years, entering well into the trillions in market cap (excluding stables) by 2030

As the quantity of tokenized assets increases, both the volume transactions and complexity of transactions will scale in tandem

The pre-eminent teams supporting trading of tokenized assets continue to choose the OP Stack today to support these assets - including Coinbase, Uniswap, Kraken, Mantle, ByBit, UpBit, and Hashkey

OP Stack provides partners unmatched trust, high performance, deep customizability, and pre-and-post mainnet support backed by an expansive partner network and long-term staying power

RWAs as the primary expected growth driver for onchain assets

The world’s largest and most reputable exchanges are choosing the OP Stack because it delivers the security and scalability required to support the most liquid markets on the planet. At the same time, the most actively traded asset classes are beginning to move onchain - starting with U.S. Treasuries and rapidly expanding to traditional financial instruments such as public and private credit, commodities, equities, and a wide range of alternative assets.

Over the past five years, real-world asset (RWA) tokenization has shown consistent, compounding growth. This trajectory is expected to accelerate meaningfully over the next decade as institutions, regulators, and market participants gain confidence in the efficiency and transparency of global, permissionless financial infrastructure.

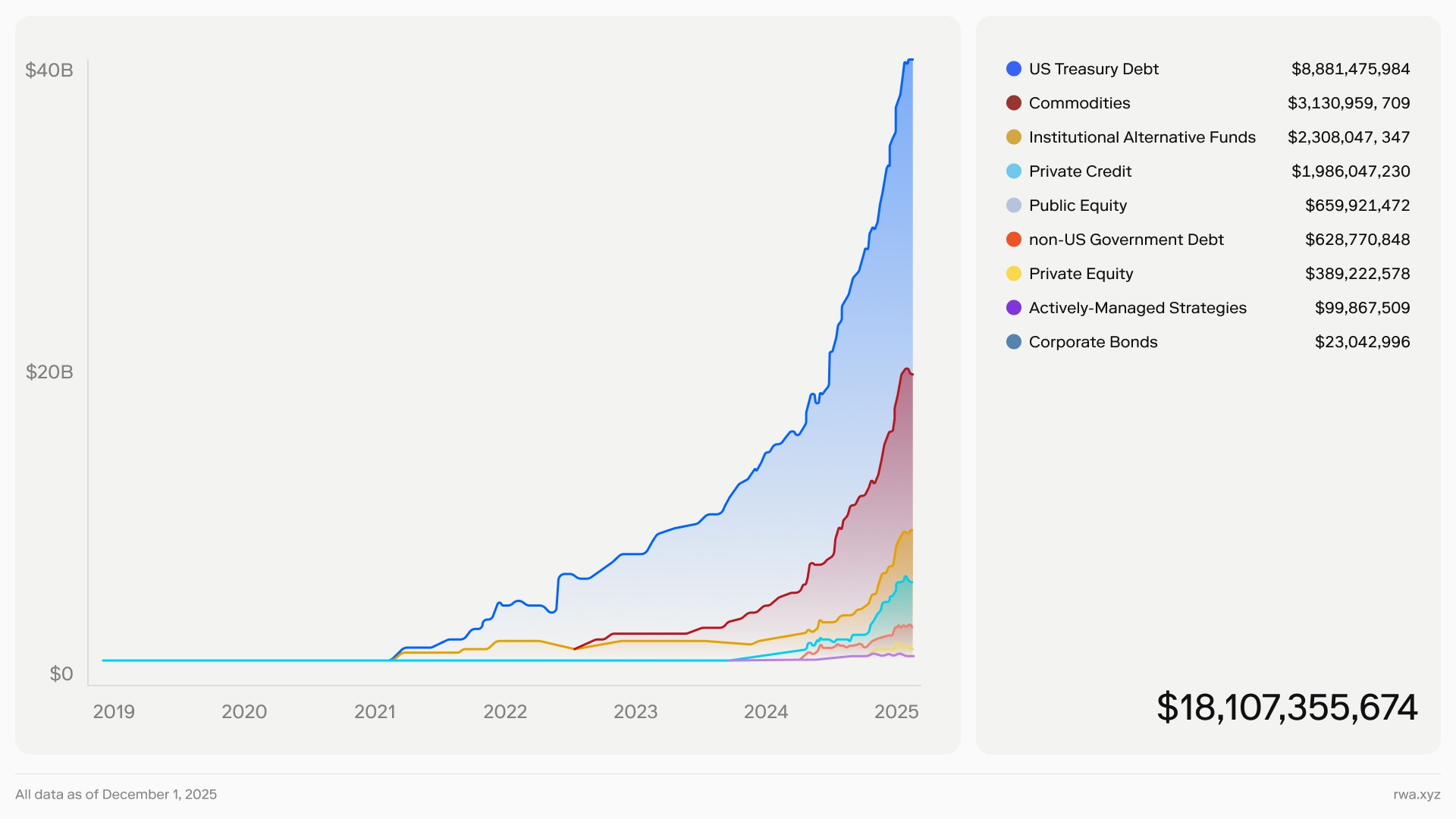

Today, approximately $35 billion in RWAs already exists onchain, as shown in Exhibit A below - a number that represents the early stages of a much larger transformation underway across global capital markets.

Exhibit A: Total RWAs being brought onchain

Over the next 3-10 years, leading global analysts, banks, and strategy firms project that tokenized assets will expand into the trillions of dollars, representing 20× to more than 300× growth from where the market stands today. These forecasts assume the continued migration of the world’s most liquid financial instruments into onchain formats - including treasuries, credit, equities, commodities, and alternative assets.

Exhibit B below highlights a range of projections from top banks and management consultancies. Across institutions, the conclusion is unmistakable: we are no longer discussing incremental, double-digit percentage increases. The industry is now aligned around double- and even triple-digit multiples as tokenization becomes a foundational pillar of global financial markets.

Exhibit B: Onchain tokenization projected growth

Scaling transactions to support increased onchain asset issuance - and the supporting defi-native transactions

As more real-world assets move onchain, ranging from U.S. Treasuries and money-market funds to private credit, equities, and commercial real estate, the volume of transactions required to service, trade, and manage those assets grows in lockstep. Tokenization transforms static, intermittently traded financial products into digitally native instruments that can settle instantly, interact with automated smart contracts, and be integrated into global liquidity pools. Each of these behaviors generates new onchain events: mints, redemptions, transfers, collateral updates, interest payments, NAV recalculations, and secondary-market trades. What once lived inside custodial systems and overnight batch processes becomes a continuous stream of verifiable, onchain activity.

The shift from traditional financial rails to programmable settlement also expands who transacts and how frequently. When assets become composable they in-turn become usable across DeFi protocols, global exchanges, wallets, and enterprise payment flows - they start to circulate far more actively than their off-chain equivalents. An onchain treasury token might be rehypothecated across lending markets, put to work in automated strategies, or rapidly moved between counterparties to meet liquidity, hedging, or treasury-management needs. Each of these actions creates a transaction, and because they rely on open, permissionless infrastructure, the marginal cost of activity is dramatically lower than in legacy systems. Lower cost and higher flexibility naturally drive more usage, more experimentation, and more transactional throughput.

As institutions, fintechs, asset managers, and enterprises adopt tokenized assets at scale, these effects compound. The growth of onchain money markets alone has already created consistent, high-velocity transaction flows from interest accruals, portfolio rebalancing, and cross-protocol arbitrage. Layer in tokenized credit, real estate, and equities, and you get a financial ecosystem where the majority of operational, trading, and settlement lifecycles occur directly onchain. This isn’t just more assets moving into digital form - it’s a structural shift that multiplies transactional demand. Ultimately, the expansion of onchain asset supply doesn’t just increase total value locked; it accelerates the velocity, diversity, and frequency of onchain transactions, setting the foundation for a significantly larger and more dynamic blockchain economy.

Why OP is best suited to support the increase in tokenized assets and supporting transactions

Today, the world’s largest and most trusted exchanges are already choosing the OP stack - including:

Teams are continuing to select the OP stack today for a range of reasons beyond just EVM compatibility.

Trust

Our partners rely on the OP Stack because it is built on years of proven production security, transparency, and open-source delivery. Institutions know they can trust an ecosystem stewarded by a team unrelentingly committed to public goods, rigorous security practices, and long-term alignment w/ our partners. The OP Stack’s architecture is openly verifiable, widely audited, and supported by one of the most credible communities in the industry. This trust is reinforced by the major exchanges, builders, and enterprises already deploying on it.

Speed and throughput

The OP Stack consistently delivers the high performance required for modern financial applications, enabling lightning-fast settlement and handling transaction volumes that traditional chains cannot sustain. Its modular design ensures constant performance improvements as new innovations in batching, compression, and execution layers come online. Teams looking to support real-time trading, clearing, or high-volume user activity know the OP Stack can scale with them. As onchain markets continue to expand, the OP Stack is engineered to stay ahead of demand.

Exhibit C: Optimism transaction throughput (TPS)

Customizability and off-the-shelf features

Unlike monolithic solutions, the OP Stack gives teams the flexibility to tailor their chain to their precise needs - whether optimizing for performance, compliance, privacy, or fee models. Builders can plug in custom data availability layers, configure sequencing options, integrate zk-proofs, and select any gas tokens to meet their customer’s or business’ desires. This modularity ensures teams can build a chain that aligns with their unique vision without sacrificing functionality. As requirements evolve, the OP Stack adapts with them.

Direct support leading into mainnet and beyond

OP Labs and the broader Optimism ecosystem provide end-to-end partnership that begins well before mainnet and continues long after launch. Teams receive hands-on architectural guidance, performance optimization support, and direct access to experts who have designed, deployed, and scaled some of the most widely used chains in the world.

Similarly, Our support extends beyond the blockchain protocol itself - we actively help partners establish the surrounding infrastructure, integrations, and ecosystem relationships required for a successful launch. We work closely with the industry’s leading infrastructure providers, tooling companies, and ecosystem applications to ensure that every Optimism chain enters the market with a complete, production-ready environment. This collaborative approach removes friction, accelerates development timelines, and gives teams the confidence that they are building on a foundation supported by proven operators and aligned contributors.

Post-launch, teams continue to rely on OP Labs for comprehensive operational and strategic support. This includes maintaining robust blockchain infrastructure; delivering performance upgrades; integrating new features such as programmable transaction ordering; and guiding chain-level and infrastructure-level development. Beyond technical execution, we also serve as thought partners for product roadmaps, ecosystem strategy, general planning, and community growth. Co-marketing opportunities and coordinated ecosystem initiatives help amplify adoption and strengthen each chain’s presence in the broader Optimism Superchain. Together, these layers of support create a smoother path to launch - and sustained success well into the future.

Staying power

The OP Stack is backed by a robust treasury, expansive ecosystem, and a clear roadmap that prioritizes sustainability over hype cycles. It is already the most widely adopted rollup framework in the world - used by leading exchanges, consumer apps, DeFi protocols, and enterprise-grade projects. This broad adoption signals durability: teams can build on the OP Stack knowing the ecosystem will only strengthen over time. With a growing community, continuous innovation, and recursive funding from our partnership models, the OP Stack is built to last.